Earlier today HPN recapped every trade that happened across the free agency period. If you want to recap that thrilling two weeks of your life in about 15 minutes, that’s the place to go.

Using those numbers, we’ve calculated who are the ultimate winners and losers of the trade period. Without further ado:

Winners

North Melbourne

North embarked on a series of low risk, high reward trades for young players who have yet to live up to their full potential. For former number 7 pick Paul Ahern, they gave GWS pick 69. For Nathan Hrovat, they gave up the equivalent of pick 81. And for Marley Williams, they gave up practically nothing. With a number of self-inflicted holes in their best 22, at least two of these three players might be able to step in and contribute right away. Regardless, the Roos pretty much can’t lose these trades because they gave nothing up in them.

The losses for the Roos during the period was that of Daniel Wells, an aging star, and Aaron Black, a player seemingly without a place at Arden Street. It is unlikely that either would have played in the next Kangaroos premiership sides. With a touch of luck, one or two of those recruited above just might. Considering their odd delistings at the end of the home and away season, the Roos did as well as they could to get themselves back on track for 2017 and beyond.

Carlton

Carlton had an extremely delicate situation to balance through the trade period, and whilst they didn’t get the biggest deal that they had on the table done (Gibbs), they did very well out of the period. With Tuohy wanting to leave Princes Park, Carlton had to try to extract as much value as they could for a player that could walk in the PSD. By getting Smedts, they get a potential replacement (if he can get fit). On paper they lost this trade, but won every other.

But the real magic for Carlton was on capitalising on the Hawthorn fire sale, and the continued pilfering of GWS offcuts. Rhys Palmer played in a final this year, and has been a very good contributor for GWS over the past few years. Getting him for nothing was a bargain, as he’ll likely get games right away for the Blues. Caleb Marchbank was in the round 1 GWS side this year before getting hurt, and just couldn’t find his way back in to a dominant squad. And Jarrod Pickett did well in the NEAFL in 2015 before being hurt for most of 2016.

Fremantle

After suffering a fall from grace last year it was clear that Fremantle needed to get some reinforcements if they were to hold any finals aspirations next year, and in this period they did just that. The Dockers finally brought Cam McCarthy through the door, at a much lower asking price than last year. Then they got a durable 23 year old triple premiership player (albeit a polarising one) for a second round pick.

At the end of the period they paid slight overs for Joel Hamling, but if he kicks on it will be a very good gamble for little outlay. Finally they grabbed a 23 year old KPF for very little (Shane Kersten), in perhaps their best deal of the period.

Fremantle also bet on themselves being better next year than they were this year, by trading their 2017 second rounder to Gold Coast for pick 35 this year.

The big out during the period was Chris Mayne’s departure to Collingwood, but the compensation pick that they got in return should cover the loss (it was on traded for Hill). Last year Fremantle lacked for tall targets and run, and these trades addressed both issues for very little in the way of costs.

St Kilda

At HPN we firmly feel that Jack Steele is a star in waiting, and that the HPN values underestimate his potential. Regardless of that, the Saints paid a pretty fair price for the Belconnen product. The Saints then committed daylight robbery on Hawthorn, in a frankly confounding trade. Finally, St Kilda paid very little to lure Koby Stevens away from the west of Melbourne, in what could be a massive steal. A very calculated trade period.

Losers

GWS

HPN technically has to call GWS losers, but in reality they did exactly what they wanted to. With such a talented list players are bound to want to find new clubs for more senior opportunities, and by getting enough picks for academy points, they’ve set themselves up for the next cycle. If there’s one criticism of the GWS trading strategy it is that they don’t quite extract full value when trading picks out, and that they don’t try to get the most for their exiting players. That said, given the amount of assets they have they don’t really need to.

GWS probably paid overs for Deledio, but the Giants can only play 22 players at once, and making sure that they maximise their premiership opportunities is their key goal. Deledio helps them do that where a 2017 first rounder probably doesn’t.

Western Bulldogs

The Bulldogs are in here as losers, but they really weren’t involved that much. The Dogs got rid of three fringe best 22 players (Hrovat, Stevens and Hamling) for a bit less than they were probably worth, but then they brought Travis Cloke in for a bit less than he should be worth. All in all, it’s hard to criticise them too much considering they just won a flag for the first time since decimal currency was introduced.

Hawthorn

Hawthorn not only offloaded two solid veterans (Lewis and Mitchell) for essentially nothing, but they basically sold the farm for just two players (O’Meara and Mitchell). They are completely out of the 2016 draft, and they are almost out of the 2017 draft. There appears to be no plan B here.

We analysed the series of loss-making moves Hawthorn made to convert their existing assets into O’Meara. The short version is that after getting Mitchell a bit cheaply, Hawthorn spent the trade period making loss-making exchanges to convert their second (36), third (54) and fourth (72) round picks, Brad Hill, and next year’s first round pick (~14), into O’Meara.

After the signing of the new CBA, every club should have excessive TPP room, so clearing contracts for TPP purposes doesn’t ring true. Vickery is a handy acquisition, but Hawthorn seemingly got the worse end of several deals here. A mild shock.

The 2016 Trade Period in Graph Form

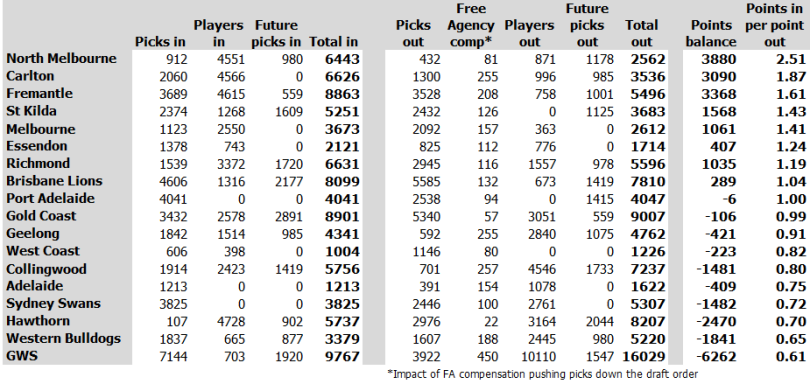

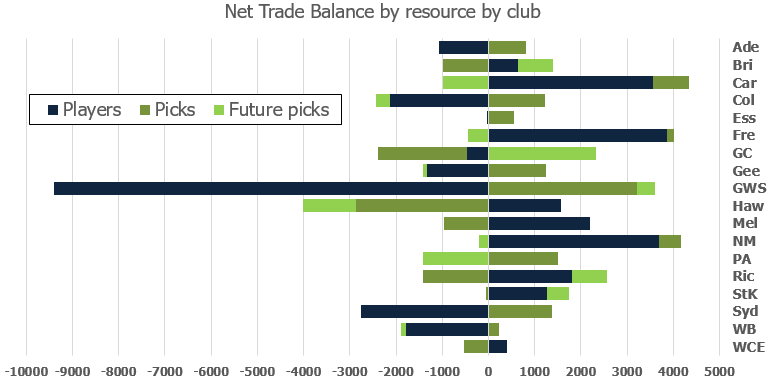

This graph breaks down the net trade balance for each component of the trade period in bar form. Each 10 points roughly equates to a game (adjusted for elite weighting). For example, GWS lost nearly 950 games of future player production in this trade period.

Carlton, Fremantle and North win big for gaining future player value, GWS got the most current draft pick value and Gold Coast concentrated on future draft pick value. Also note how Port has essentially eschewed the 2017 draft in favour of the 2016 one.

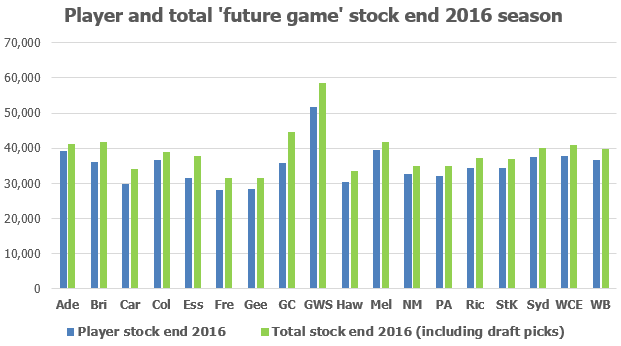

For a more holistic look at where each club stood at the end of 2016, the next chart is for you.

Player stock is an estimate of future game potential of the 2016 playing lists. Total stock adds the draft picks clubs had before trading began. Note how far ahead of the pack GWS is – with only Gold Coast in sight. At the other end of the scale, Hawthorn, Geelong, Fremantle and Carlton appear to be aging quickly.

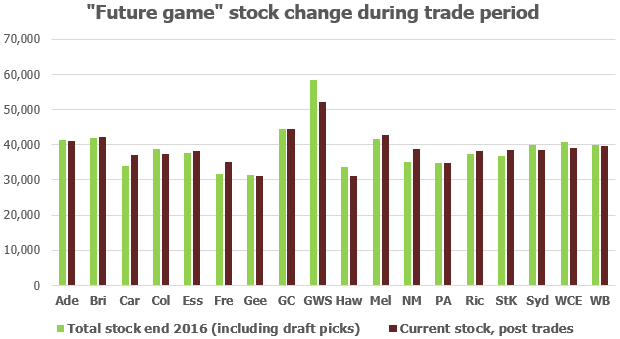

Finally, this graph shows how well each club did out of the trade period.

Despite their massive loss through the 2016 period, GWS sits comfortably ahead of every other club in future game stock, illustrating the sheer quantity of assets they hold and why they’re fine letting them go cheaply.

Hawthorn, sitting at the bottom already, somehow further decreases their future game stock in the desperate pursuit of one more flag before their window closes.